A Critique of Pure Gold

Mini Teaser: With Republicans eyeing a return to the gold standard, TNI presents a piece from its archives on tea partiers looking to push the government out of the monetary-policy-making business.

In fact this may have been one of the few actual examples of Keynesian demand stimulus prior to John Maynard Keynes. (The General Theory of Employment, Interest and Money, in which Keynes first fully articulated the case for public spending to stimulate demand during downturns, was only published in 1936.) It was a successful example at that, judging from the macroeconomic consequences. Understandably, this did nothing to allay Hayek’s concerns.

Paul describes himself as having been profoundly influenced by Hayek’s account of how managed money opened the door to the disaster that was Nazi Germany. And he sees the United States walking down the same treacherous path. In End the Fed, he devotes a long passage to Richard Nixon’s decision in August 1971 to close the gold window—to suspend the statutory obligation of the United States to pay out gold to foreign governments holding U.S. dollars at a fixed price of $35 an ounce—singling that choice out as the key event prompting him to run for Congress. The Bretton Woods system, of which the $35 gold peg was an artifact, may have been only a “pseudo-gold standard” (Paul’s words), in that the commitment to exchange gold for dollars was extended only to foreign governments and central banks. But its abandonment, as Paul describes it, cleared the way for the dreaded specter of fiat money. It removed all remaining restraints on the ability of the central bank to underwrite the government’s budget deficits. It gave the Federal Reserve System full freedom to manipulate the country’s money supply. It was an “unprecedented experiment” in monetary planning.

And, much as Hayek would have predicted, it was accompanied by other measures expanding government control of the economy. Nixon supplemented his decision to abandon the gold standard with wage and price controls. He slapped a 10 percent surcharge on U.S. imports, discouraging free international trade. He allowed the budget deficit to widen further, famously justifying the deficit spending used to goose the economy in the run-up to his 1972 reelection campaign on the grounds that “we are all Keynesians now.” The import surcharge and the wage and price controls were advertised as temporary, and history would prove them as such. But not so the budget deficits, aside from the brief period of balanced budgets in the mid-to-late 1990s. For Paul, those deficits were the inevitable consequence of managed money. They were steps down Hayek’s slippery slope. Hence his quest to end the government’s ability to manipulate the money supply: to “end the Fed” and restore the gold standard.

BUT IF Representative Paul has been agitating for a return to gold for the better part of four decades, why have his arguments now begun to resonate more widely? One might point to new media—to the proliferation of cable-television channels, satellite-radio stations and websites that allow out-of-the-mainstream arguments to more easily find their audiences. It is tempting to blame the black-helicopter brigades who see conspiracies everywhere, but most especially in government. There are the forces of globalization, which lead older, less-skilled workers to feel left behind economically, fanning their anger with everyone in power, but with the educated elites in particular (not least onetime professors with seats on the Federal Reserve Board).

There may be something to all this, but there is also the financial crisis, the most serious to hit the United States in more than eight decades. Its very occurrence seemingly validated the arguments of those like Paul who had long insisted that the economic superstructure was, as a result of government interference and fiat money, inherently unstable. Chicken Little becomes an oracle on those rare occasions when the sky actually does fall.

More than that, the period leading up to the crisis displayed a number of specific characteristics associated with the Austrian theory of the business cycle. The engine of instability, according to members of the Austrian School, is the procyclical behavior of the banking system. In boom times, exuberant bankers aggressively expand their balance sheets, more so when an accommodating central bank, unrestrained by the disciplines of the gold standard, funds their investments at low cost. Their excessive credit creation encourages reckless consumption and investment, fueling inflation and asset-price bubbles. It distorts the makeup of spending toward interest-rate-sensitive items like housing.

But the longer the asset-price inflation in question is allowed to run, the more likely it becomes that the stock of sound investment projects is depleted and that significant amounts of finance come to be allocated in unsound ways. At some point, inevitably, those unsound investments are revealed as such. Euphoria then gives way to panic. Leveraging gives way to deleveraging. The entire financial edifice comes crashing down.

This schema bears more than a passing resemblance to the events of the last decade. Our recent financial crisis had multiple causes, to be sure—all financial crises do. But a principal cause was surely the strongly procyclical behavior of credit and the rapid growth of bank lending. The credit boom that spanned the first eight years of the twenty-first century was unprecedented in modern U.S. history. It was fueled by a Federal Reserve System that lowered interest rates virtually to zero in response to the collapse of the tech bubble and 9/11 and then found it difficult to normalize them quickly. The boom was further encouraged by the belief that there existed a “Greenspan-Bernanke put”—that the Fed would cut interest rates again if the financial markets encountered difficulties, as it had done not just in 2001 but also in 1998 and even before that, in 1987. (The Chinese as well may have played a role in underwriting the credit boom, but that’s another story.) That many of the projects thereby financed, notably in residential and commercial real estate, were less than sound became painfully evident with the crash.

All this is just as the Austrian School would have predicted. In this sense, New York Times columnist Paul Krugman went too far when he concluded, some years ago, that Austrian theories of the business cycle have as much relevance to the present day “as the phlogiston theory of fire.”

But the Austrians then go on—and this is where they and other economists part company—to argue that the best and, ultimately, only feasible response to this destabilizing cycle is inaction. Inaction is counseled first because of the existence of moral hazard. If the culprits don’t feel pain and learn a lesson, they will engage in the same reckless behavior over and over again.

Second, the overhang of unsound investment projects must be liquidated in order to prevent them from becoming a drag on the economy, and discouraging that process only delays the subsequent recovery. Eighty years ago Lionel Robbins, then Hayek’s colleague at the London School of Economics, famously made these arguments about how governments and central banks should respond, or more precisely not respond, to the Great Depression of the 1930s. An American member of the Austrian School, Murray Rothbard, later applied the same argument to the Great Depression in the United States.

The first part of their logic is impeccable: inaction in the face of an unfolding financial crisis is a sure way of inflicting pain. Unfortunately, the pain is meted out to the innocent as well as the guilty. It is felt by the workers thrown out of jobs in the resulting recession as well as by financiers who see their portfolios shrink.

Society, in its wisdom, has concluded that inflicting intense pain upon innocent bystanders through a long period of high unemployment is not the best way of discouraging irrational exuberance in financial markets. Nor is precipitating a depression the most expeditious way of cleansing bank and corporate balance sheets. Better is to stabilize the level of economic activity and encourage the strong expansion of the economy. This enables banks and firms to grow out from under their bad debts. In this way, the mistaken investments of the past eventually become inconsequential. While there may indeed be a problem of moral hazard, it is best left for the future, when it can be addressed by imposing more rigorous regulatory restraints on the banking and financial systems.

And we have learned how to prevent a financial crisis from precipitating a depression through the use of monetary and fiscal stimuli. All the evidence, whether from the 1930s or recent years, suggests that when private demand temporarily evaporates, the government can replace it with public spending. When financial markets temporarily become illiquid, central-bank purchases of distressed assets can help to reliquefy them, allowing borrowing and lending to resume.

These statements are controversial. They are not what the critics of the Federal Reserve System see. They see a budget deficit that has grown explosively, which they take as evidence of government again pandering to special interests whose cries only grow louder in tough economic times. They see a Federal Reserve that has engaged in large-scale purchases of Treasury securities under the rubric of quantitative easing (QE), enabling this government spending. They see the central bank intervening in the mortgage and securitization markets in unprecedented ways. They see runaway inflation, if not in the data then in the offing.

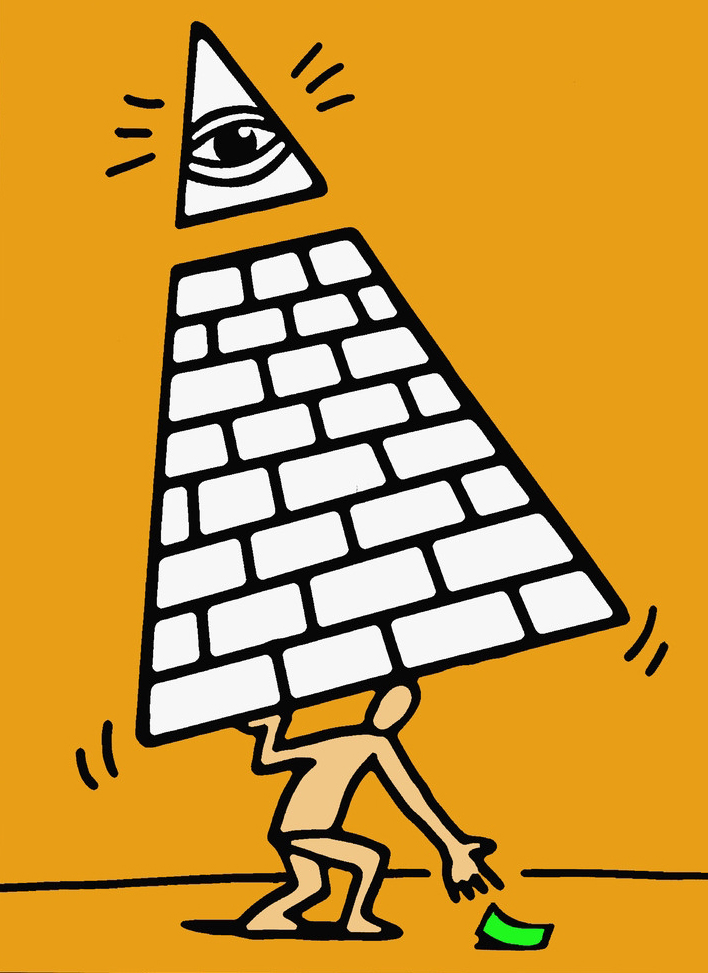

Image: Pullquote: Bizarre is the belief that putting the United States on a gold standard will somehow guarantee balanced budgets, low taxes, small government and a healthy economy.Essay Types: Essay

Pullquote: Bizarre is the belief that putting the United States on a gold standard will somehow guarantee balanced budgets, low taxes, small government and a healthy economy.Essay Types: Essay