Risks to the Japan-China 'Tactical Detente'

Long-standing tensions between China and Japan thus could reemerge and threaten the current detente. One area of risk that gets less attention is China’s influence operations, which can spark a backlash in Japan and throw relations back off track.

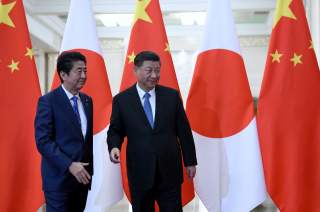

Japan is preparing for Chinese leader Xi Jinping’s spring 2020 state visit, which will serve as a litmus test of the historically fraught bilateral relationship. The meeting could produce a signed “fifth political document” defining the relationship. While Japanese prime minister Shinzo Abe is known as a China hawk, he has been taking a pragmatic approach toward Japan’s neighbor since the nadir in the relationship in 2012. Over the past two years, China and Japan have established a superficial “tactical detente” or “new start” to hedge against the uncertainty from the U.S. trade war with China. Oddly, President Donald Trump’s unpredictability has worked to reduce some tensions in Asia as big rivals seek to reduce risk. Meanwhile, Japan and the United States have switched their positions on China with the United States growing more hawkish, creating anxiety in Japan about being out of sync with its ally. Long-standing tensions between China and Japan thus could reemerge and threaten the current detente. One area of risk that gets less attention is China’s influence operations, which can spark a backlash in Japan and throw relations back off track.

Unlike some rich democracies, Japan has generally resisted overt, sharp political influence from its massive neighbor China due to strict campaign finance rules, regulations favoring domestic industry, a homogenous population, and bias of suspicion toward China. Yet, Chinese influence in Japan is like air: it’s everywhere and nowhere in particular. Chinese cultural influence is Japan is ubiquitous: it’s in the language, art, cuisine, literature, architecture, music, law, and philosophy. But after about two thousand years of intense China-Japan relations (documentation of the bilateral relationship dates back to the year 57AD), including wars, invasions, and rivalries, Japanese society has become accustomed to living side-by-side with China yet not necessarily together, and the country has proved to be relatively impenetrable against Chinese political warfare. But there are risks to the relationship. That’s one of the main takeaways of more than forty interviews in Japan I have conducted over the past two years on this topic.

Public Sentiment as Political Influence

One quantifiable way to measure political influence is to look at public sentiment, and in this regard, Japan stands apart as one of the most negatively disposed countries in the world toward China. According to a spring 2019 Pew Research poll, Japan had the most negative views of China among all thirty-four countries surveyed at 85 percent negative. Since Japan’s official opening to China in 1972, when Japanese public sentiment according to Japan’s Cabinet Office polls toward China was significantly more positive—coinciding with the nation’s “panda boom”—public sentiment has fallen consistently ever since, while Japanese sentiment toward the United States has remained consistently the most positive.

In stark contrast, the Chinese public opinion of Japan has enjoyed a marked improvement since the countries embarked on the bilateral detente, and the Chinese people view Xi’s upcoming spring visit to Japan as a positive, decisive event in the relationship. Opinions in China and Japan are so asymmetrical that the situation elicited a complaint from Xi, who noted on Nov. 22, 2019, that the Japanese opinion of China is plagued by bias and prejudice. The Bloomberg report astutely noted that Xi’s complaint would probably only make things worse. “The fact that Chinese people have a more favorable view of Japan shows that China is following the right path,” Xi said, adding, “we are encouraging people to visit Japan.” The Abe administration has relaxed tourist visas from China, and, indeed, from 2013 to 2018, Chinese visits to Japan increased 600 percent to a record high of more than eight million in 2018. (About 2.5 million Japanese visit China each year.) By contrast, Japanese television news featured stories about U.S.-China economic conflict “almost every day” during the polling period of September 2019. When media is profit-driven, it caters to the audience’s bias, and the Japanese public appears to thirst for China-bashing stories. Chinese state media serves the interest of the state.

Japan enjoys a positive image not only in bilateral China-Japan polls but also in regional and global ones. In the broader region, for example, polls indicate that while China is becoming much more influential, it is seen as an untrustworthy, revisionist power that might not do “the right thing,” according to a well-known 2019 ISEAS study of attitudes among 1,008 elites in Southeast Asia. In that same study, Japan is seen as the most trusted and benevolent country among great powers. Globally, the situation is much the same. A 2019 U.S. News & World Report study in partnership with the BAV Group and the Wharton School ranks Japan as the number two best overall country and number six for cultural influence in the world, while China places number sixteen. In terms of political power, the same U.S. News & World Report study ranks China at number three and Japan at number seven. International publications call Tokyo the safest, most livable, and most reputable city in the world. Similarly, Conde Nast Traveler in 2019 includes three Japanese cities (Tokyo, Kyoto, and Osaka) among its list of best big cities, while no Chinese city made the list.

In sum, China’s positives, such as its economic growth, military power, and political influence paradoxically manifest as threats in the global and Japanese imaginations, while its negatives, such as human-rights violations, handling of the Hong Kong democracy protests and Uighurs in Xinjiang, or territorial ambitions in the East and South China Seas, serve to add to the list of negatives. Either way, China can’t seem to win. Nevertheless, sharp episodes of influence do present a risk to sustaining relative peace.

The China Connection in Recent Scandals

A political scandal involving China is pretty rare in Japan. It is so rare that a 2018 book on the history of Japanese political scandals only mentions China twice and the country’s name does not even make it into the index. Yet, a Chinese government connection with a recent bribery scandal involving Japanese politician Tsukasa Akimoto of the ruling LDP has threatened to harm the Japan-China relationship. It also taints the image of an already-controversial Japanese economic growth strategy—the promotion of casino properties or so-called integrated resorts. The Japanese public is wary of the spread of gambling as it is about the country’s big neighbor China.

Akimoto is a part of the LDP’s powerful Nikai faction, which is the most pro-China arm of the ruling party and is named after the LDP Secretary General Toshihiko Nikai from Wakayama Prefecture. Literally a panda-hugger, Nikai helped to bring five giant pandas from China to a zoo in Wakayama, which now has more pandas than Ueno Zoo in Tokyo. Nikai's efforts to return the favor by erecting a statue of Jiang Zemin was unsuccessful, however. In November, Secretary General Nikai advocated for Xi Jinping’s upcoming state visit. Serving as the prime minister’s special envoy to China, Nikai has met Xi Jinping in Beijing in April 2019 and he has advocated for Japanese cooperation with China, on its Belt and Road Initiative, for example, regardless of what the United States thinks. Nikai’s relationship with China goes back decades to his advocacy for sending Japanese foreign aid, which it provided to China from 1979 to 2018, becoming China’s largest donor.

On Dec. 24, 2019, Abe expressed his enthusiasm to prepare for Chinese leader Xi Jinping’s upcoming state visit in spring 2020. He made the statement during his visit to Chengdu, China, after attending the Japan-China-South Korea trilateral summit held there. A month earlier, some of Abe’s conservative members of the ruling LDP announced their opposition to Xi’s visit, and delivered the message personally to Abe at his office on November 19. Those conservatives have established a group called the Conference to Japan’s Dignity and National Interest (JDI) in June 2019; the association has forty-eight members as of November 2019.

On the following day, on December 25, Akimoto, a parliament member who has been a key figure in crafting Japan’s new integrated resorts development strategy was arrested for allegedly receiving a total of 3.7 million yen ($33,000) in bribes from China’s leading online sports gambling service provider 500.com. He is accused of receiving a 3-million-yen election gift (above the 1.5 million yen legal limit) in cash placed in a paper bag with Japanese sweets from 500.com’s advisor Masahiro Konno on September 28, 2017—the same day that Abe dissolved the lower house of parliament. The practice of delivering bribes in bags with sweets is such a familiar trope in Japanese TV dramas that it is almost comical. He is also accused of receiving seven hundred thousand yen to cover his trip to Hokkaido in February 2018 while he was the senior vice minister in charge of overseeing the government’s integrated resorts strategy. He served in that post from August 2017 to October 2018.

Shenzhen-based 500.com has Chinese government-backed chipmaker Tsinghua Unigroup as a major shareholder. Tsinghua Unigroup’s stake in 500.com has increased since it invested in June 2015 after its founder, Man San Law (Luo Zhaoxing in Mandarin), resigned as CEO (but remained chairman) a month earlier when the company reported its first quarterly loss after listing on the New York Stock Exchange in November 2013. The Chinese government had banned online lottery sales in March 2015, thus harming the company’s business model. Tsinghua Unigroup’s stake in the company amounted to 31.89 percent as of the end of 2018, although it only has 14.87 percent of voting shares, lower than 30.19 percent owned by its founder, Law, according to its latest annual report. As the company’s losses continued, 500.com has tried to find alternative revenue sources including branching out outside of China, including to Japan. It has replaced its chairman four times since January 2017, when Law resigned as chairman, all from Tsinghua Unigroup, according to previous annual reports.