'Stimulus Check' Question: How Many Americans Are Eligible for The Child Tax Credit?

The IRS is reaching out to American families to notify them of their eligibility to apply.

Here's What You Need to Remember: For those who are still wondering if they qualify for this new government-issued cash windfall, just make sure to be on the lookout for a couple of letters that were mailed off by the IRS. The first one—sent to more than thirty-six million American families—targets those who may be eligible to receive the monthly credit payments. Then the second letter, which will be more personalized, will state the estimated amount of their monthly checks.

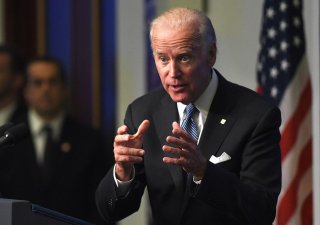

In just a few short weeks, the Internal Revenue Service will be tasked with disbursing the newest so-called coronavirus “stimulus” checks to financially struggling Americans—the expanded child tax credits from President Joe Biden’s American Rescue Plan.

These potentially sizeable checks—$3,600 annually for a child under the age of six and up to $3,000 for children between ages six and seventeen, amounting to a $250 or a $300 payment each month through the end of the year—will begin landing in eligible parents’ bank accounts starting July 15.

For those who are still wondering if they qualify for this new government-issued cash windfall, just make sure to be on the lookout for a couple of letters that were mailed off by the IRS.

The first one—sent to more than thirty-six million American families—targets those who may be eligible to receive the monthly credit payments. Then the second letter, which will be more personalized, will state the estimated amount of their monthly checks.

The IRS has also taken action to assist the nation’s lowest-income earners who often don’t make enough money throughout the year to have to file taxes. Without the tax returns, the agency wouldn’t have necessary information—such as an address, bank account or routing numbers—on file to properly disburse the funds.

Therefore, a tool was “developed in partnership with Intuit and delivered through the Free File Alliance … (and will provide) a free and easy way for eligible people who don't make enough income to have an income tax return-filing obligation to provide the IRS the basic information needed.”

“This new tool will help more people easily gain access to this important credit as well as help people who don’t normally file a tax return obtain an Economic Impact Payment,” IRS Commissioner Chuck Rettig said in a statement.

“We encourage people to review the details about this important new effort,” he added.

Moreover, there will be other portals designed specifically for child tax credits that will be up and running by July 1 to help individuals update and adjust their personal financial information and any changes to the number of child dependents. Keep in mind that babies born in 2021 will indeed be eligible for the tax credits.

“Later this year, individuals and families will also be able to go to IRS.gov and use a Child Tax Credit Update Portal to notify IRS of changes in their income, filing status, or number of qualifying children; update their direct deposit information; and make other changes to ensure they are receiving the right amount as quickly as possible,” the agency states.

Ethen Kim Lieser is a Minneapolis-based Science and Tech Editor who has held posts at Google, The Korea Herald, Lincoln Journal Star, AsianWeek, and Arirang TV. Follow or contact him on LinkedIn.

This article first appeared earlier this year and is being reposted due to reader interest.

Image: Reuters