There’s No Alternative: Modern Industrial Society Needs Energy

The assertion that Russian energy is a marginal part of the global economy, and that shutting Russia out of global markets entirely would have minimal impact, is in defiance of the facts.

Much of the debate over American policy toward Russia has concerned energy. Can Russian oil and gas be replaced in the supply chain for America’s allies? How far can the West tighten the screws on Russia’s economy? In their recent Foreign Policy piece, “The World Economy No Longer Needs Russia,” Jeffrey Sonnenfeld and Steven Tian assert that Russian energy is a marginal part of the global economy, and that shutting Russia out of global markets entirely would have minimal impact. That argument might embolden Washington but is simply not rooted in facts.

The assertion that “the world no longer depends on Putin’s oil” is either hyperbole or reflects a serious misunderstanding of oil markets. The Energy Information Agency’s (EIA) latest forecast calls for an average global production of 102 million barrels per day (mbpd) in 2023–24 and consumption of just 0.6 mbpd less. Russia’s 2022 oil production was some 11 mbpd. The loss of 11 percent of global supply with a cushion of just 0.6 percent on average would cause prices to skyrocket, severely damaging the world economy. Furthermore, EIA production estimates may be overly rosy as supply disruptions are always possible, and the reopening of the Chinese economy following the end of zero-covid policies may stoke demand.

The precariousness of the supply-demand balance was highlighted by the announcement on February 10 that Russia would cut output by 0.5 mbpd. Oil prices spiked 2.2 percent since, in the words of UBS analyst Giovanni Staunovo, in the short term there is nobody to fill the supply gap created by the Russian cuts.

In light of supply tightness, oil flows have simply been re-routed. Russian exports to India and China have increased substantially, with subsequent reexport to Europe, either as crude or refined products, at higher prices. Even Saudi Arabia has been increasing imports of Russian crude for domestic use, allowing it to export more of its own product. Russian exports simply have not decreased.

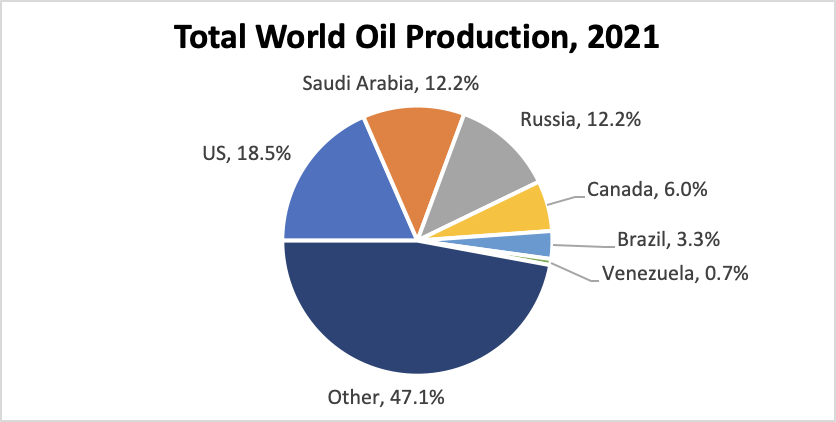

The authors respond to fears of lost supply by asserting that “any lost Russian crude will be seamlessly and easily replaced within weeks.” This outright ignores the realities of global oil production. Of the sources mentioned—the United States, Venezuela, Canada, and Brazil—only the United States would seem a viable replacement. But because the expected increase of 0.55 mbpd in 2023, and another 0.40 in 2024, will produce, combined, less than one-tenth of Russian production. These numbers cannot support the assertion made by Sonnenfeld and Tian.

Canada and Brazil are likely to increase output even less. Venezuela, after twenty-three years of rule by Hugo Chávez and Nicolás Maduro, as well as fifteen years of punishing U.S. sanctions, has seen its output plummet from 3.3 to 0.7 mbpd. The idea that it can substantially increase oil production in any appreciable amount in any policy-relevant timeframe is not believable. The U.S. Treasury’s recent granting of Chevron a six-month license to operate in Venezuela, while positive, is a drop in the bucket. Many years and billions of dollars of capital expenditure will be required to restore production.

Saudi Arabia is similarly unlikely to be able to step in. OPEC spare capacity, mostly Saudi and often estimated by politicians at 2.5 mbpd, is likely significantly less due to years of declining output and lowered capital expenditure. Based on information coming out of the kingdom and by independent experts, the number is probably closer to 0.5 mpbd. Pushing output up will require time and investment.

Moreover, OPEC’s primary desire is to maximize profit. Increasing output may run counter to this since, all else equal, rising supply means lower prices. The claim that Vladimir Putin “coerce[d] Saudi Arabia” to cut production quotas looks strange, not only because the only source cited is a Politico opinion piece written by the authors and two congressmen, but also because cutting production leads to higher prices, in line with Saudi rational self-interest.

Additionally, the argument that pausing arms transfers will pressure Saudi Arabia to ramp up production has little historical precedent. Instead, in recent years Riyadh has chosen increased cooperation with Russia and more importantly China—offering Saudi Arabia a chance to lessen the impact of U.S. pressure.

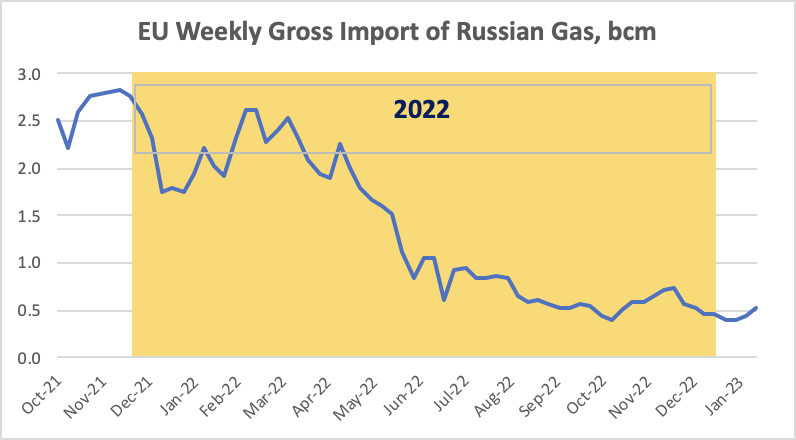

The reality of the gas market picture is also different. Sonnenfeld and Tian claim “Putin has choked off natural gas supplies to Europe” when in fact Nord Stream was operating at full capacity in the first half of 2022 and then at declining capacity for another three months before being sabotaged at the end of September. Gas flow through Ukraine was at 100 percent before dropping to 67 percent when Kyiv closed the Sokhranovka pipe. Russian LNG exports to Europe (22 billion cubic meters, or bcm, last year) continue to this day, as do flows through Turkey via Blue Stream and Turk Stream.

The statement that “Europe is now assured sufficient energy supply well into 2024 at a minimum” is not plausible, given that Russian flows will be considerably lower in 2023 than in 2022, barring a settlement of the war and a herculean effort to restore economic relations. In other words, an even greater volume of gas must be replaced this year and next. Warmer than-usual weather has helped, as Sonnefeld and Tian note, but this factor is variable and unpredictable, and should not form the basis of policy. At best, it has bought Europe some more time unless they want the process of deindustrialization to continue.

The 185 bcm of gas Europe imported from Russia in 2021 simply cannot be replaced in the short term and/or at a reasonable cost. Losses were partially offset by a 64 bcm increase in LNG imports, including an impressive 42 bcm increase from the United States. Still, the numbers cannot support the claim that “[t]he EU now purchases more LNG than it ever purchased Russian gas.”

The cost of LNG is also significantly higher than pipeline gas, with serious economic consequences—all the more so since the EU had to bid cargoes away from Asia, where LNG is already traded at a premium. This has the side effect of pricing poorer countries, like Bangladesh and Pakistan, out of the market, resulting in shortages and rationing. Given flattish domestic production, rising U.S. LNG exports will put upward pressure on the price of natural gas, which in the United States is the fuel for 38 percent of electricity and 46 percent of home heating, and is the feedstock for thousands of products from plastics to fertilizer, driving their prices up as well.

European nuclear energy, which would help alleviate part of this, has been beset by maintenance issues. While Germany has discovered a new enthusiasm for nuclear power after years of phasing it out, setting up new plants or even revitalizing old ones will take time. Likewise, not only will “renewables” not solve the problem, as asserted, but false hope in renewables is one of the major reasons Europe in general and Germany specifically is in this situation. In Germany, the share of renewables increased 364 percent from 2000 to 2020, but still account for only 18 percent of total energy supply. Additionally, renewables include biomass, such as clear-cutting forests to make wood pellets, and impose costs and problems due to their intermittency and other negative externalities for generation and the grid.

In short, there is no free ride, no magic source of energy, to power an industrial economy.

The authors repeatedly seem to have insight into Putin’s thoughts and thought processes despite the lack of basis for such vision. Absent confirmatory actions or at least rhetoric, statements like “hoping that Europeans . . . would turn on their leaders,” “long a Putin obsession,” “miscalculations,” and “whims” are difficult to accept and do not serve as support for the proffered arguments.

The desire to punish Russia for its invasion is entirely understandable, but foreign policy must be based on the world we live in. Eliminating Russian energy would have devastating consequences for the global economy. To suggest otherwise does a disservice to those who will suffer from such policies.

Scott Semet has been working on global financial markets for over twenty-five years across the spectrum of financial services, private equity, and venture capital, including establishing and running the research department of major financial institutions. Recently, he has focused on the intersection of business, economics, and politics in Eurasia. He has an MA from Yale University Graduate School and an MBA from Columbia Business School.

Image: curraheeshutter/Shutterstock.