No Stimulus For You: Should You Say No to Biden’s Child Tax Credits?

In recent weeks, there has been increasing chatter about the potential benefits regarding opting out of these child tax credits. In fact, the IRS has given a warning that some tax credit recipients may have to pay back a portion of these payments during tax season next year.

Over the past two months, the disbursement of tens of millions of $1,400 coronavirus stimulus checks under the American Rescue Plan has been a lifesaver for many struggling American families.

But with nearly all of the remaining payments sent out, many Americans are now increasingly worrying about how to pay for their basic everyday needs, such as groceries and rent.

In an effort to help ease those concerns, know that the Internal Revenue Service has already confirmed that monthly payments from the new $3,000 or $3,600 child tax credit will begin landing in the bank accounts of millions of eligible parents starting in July.

Due to the ongoing pandemic, these credits have been extended to lower-income families—and they are now eligible to claim as much as $3,600 per year for a child under the age of six and up to $3,000 for children between six and seventeen.

This all means that for a family headed by a couple earning less than $150,000 or an individual making under $75,000, they now qualify to get a $250 or $300 payment every month.

However, in recent weeks, there has been increasing chatter about the potential benefits regarding opting out of these child tax credits. In fact, the IRS has given a warning that some tax credit recipients may have to pay back a portion of these payments during tax season next year.

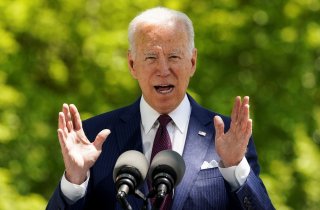

Know that this could occur because President Joe Biden’s legislation directs the federal government to issue advance payments of the credit in periodic installments. These advanced payments are largely based off the agency’s estimates on available data, such as income, marital status, and number and age of qualifying dependent children.

If there are, however, any outdated or inaccurate data, they could easily trigger an overpayment of the child tax credit—which means that the impacted individual will be responsible for any difference in the final amount.

According to the IRS, a portal will eventually be launched for the child tax credit payments so that taxpayers’ information can be added or updated more conveniently. They can opt out as well if they choose to do so.

“Eligible taxpayers who do not want to receive advance payment of the 2021 Child Tax Credit will have the opportunity to decline receiving advance payments. Taxpayers will also have the opportunity to update information about changes in their income, filing status or the number of qualifying children. More details on how to take these steps will be announced soon,” the agency stated.

Do keep in mind that if no action is taken on the portal and taxes are filed by the May 17 deadline, eligible individuals will automatically receive monthly payments.

Ethen Kim Lieser is a Minneapolis-based Science and Tech Editor who has held posts at Google, The Korea Herald, Lincoln Journal Star, AsianWeek, and Arirang TV. Follow or contact him on LinkedIn.