$3,600 'Stimulus Check' On The Way? Joe Biden Has More Money For You.

Do take note that the $1.9 trillion stimulus bill enabled the expansion of child tax credits that generally allowed families to claim a credit of up to $2,000 for children under the age of seventeen. But they now qualify to collect as much as $3,600 per year for a child under the age of six and up to $3,000 for children between ages six and seventeen.

Child Tax Credit Looks to Take Sting Out of States Ending Enhanced Unemployment

With the Internal Revenue Service in the final weeks of disbursing coronavirus stimulus checks and two dozen states announcing that they will end their participation in an enhanced unemployment program that pays an extra $300 a week, it appears that those Americans who are still struggling financially amid the ongoing pandemic can’t catch a break.

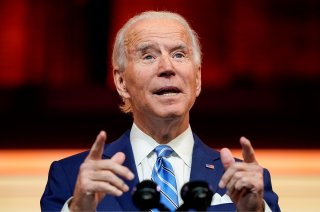

But thanks to President Joe Biden’s American Rescue Plan, they can take comfort knowing that more help is indeed on the way via the expanded child tax credit.

Do take note that the $1.9 trillion stimulus bill enabled the expansion of child tax credits that generally allowed families to claim a credit of up to $2,000 for children under the age of seventeen. But they now qualify to collect as much as $3,600 per year for a child under the age of six and up to $3,000 for children between ages six and seventeen.

This all means that eligible parents can receive a $250 or a $300 direct payment each month through the end of this year. In addition, eighteen-year-olds and full-time college students who are aged twenty-four and under can give parents a one-time $500 payment.

“The American Rescue Plan is delivering critical tax relief to middle class and hard-pressed working families with children. With today’s announcement, about 90 percent of families with children will get this new tax relief automatically, starting in July,” Biden said in a statement.

“While the American Rescue Plan provides for this vital tax relief to hard working families for this year, Congress must pass the American Families Plan to ensure that working families will be able to count on this relief for years to come. For working families with children, this tax cut sends a clear message: help is here,” the president added.

If the nearly $2 trillion American Families Plan ever gets green-lighted, know that the child tax credit could be extended four more years through 2025. In a recent press briefing, White House Press Secretary Jen Psaki touted the bill’s potential reach.

“If passed, the families of tens of millions of children will continue to get regular payments … we think that’s a proposal with a long-term benefit,” she said.

Meanwhile, some states that are withdrawing from the enhanced unemployment program are offering financial incentives to unemployed workers who eventually accept a job. For example, in Arizona, the state’s Back to Work program is giving a one-time $1,000 cash payment to unemployment recipients who accept part-time employment and $2,000 to full-timers.

“In Arizona, we’re going to use federal money to encourage people to work instead of paying people not to work,” Gov. Doug Ducey recently said in a press conference.

Ethen Kim Lieser is a Minneapolis-based Science and Tech Editor who has held posts at Google, The Korea Herald, Lincoln Journal Star, AsianWeek, and Arirang TV. Follow or contact him on LinkedIn.