New Monthly ‘Stimulus Checks’ to Drop in Less Than a Month

This newest government-issued cash windfall will allow parents to net as much as $3,600 per year for a child under the age of six and up to $3,000 for children between ages six and seventeen.

There is no question that the past year likely has been the hardest on low-income Americans who were saddled with the responsibility of raising their children.

But big-time help is less than a month away in the form of recurring monthly payments from the expanded child tax credits—seen by some as the unofficial version of another round of coronavirus stimulus checks—will be heading into eligible parents’ bank accounts beginning July 15.

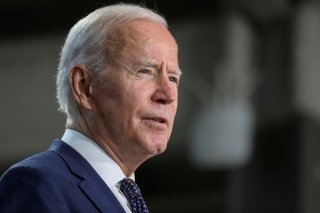

Thanks to President Joe Biden’s $1.9 trillion American Rescue Plan, this newest government-issued cash windfall will allow parents to net as much as $3,600 per year for a child under the age of six and up to $3,000 for children between ages six and seventeen—meaning that a $250 or a $300 cash payment for each child will be deposited every month till the end of the year.

After July 15, the following payments are slated to be made on August 13, September 15, October 15, November 15, and December 15, according to the Internal Revenue Service.

“I have repeatedly said that America’s middle class deserves a tax cut, and we’re providing a significant tax cut to America’s working families with children through the largest-ever child tax credit,” Biden said in a statement.

“This tax cut will give our nation’s hardworking families with children a little more breathing room when it comes to putting food on the table, paying the bills, and making ends meet. Nearly every working family with children is going to feel this tax cut make a difference in their lives,” he added.

To raise awareness of the federal government’s new program, the White House has launched the website www.childtaxcredit.gov to give eligible parents more details on how to get their hands on the credits.

However, what recent polls, reports, and studies are pointing out is that the government might need to be even more generous to assist struggling Americans—and that could mean expanding the child tax credits for years to come.

A recent report by the Annie E. Casey Foundation revealed that a permanent expansion of the child tax credit has the potential to lift more than four million children out of poverty.

The latest data from the U.S. Census Bureau show that about thirty-four million people, including ten million children, live in poverty in the United States.

“Every child needs food, health care and safe and stable housing. Millions of households with children already lacked these necessities before the pandemic, and this economic and public health catastrophe brought millions more face-to-face with challenges ranging from lost health insurance and bare pantries to the threat of homelessness due to eviction or foreclosure,” according to the advocacy group.

“To continue on progress already made on recovery, the Foundation recommends: making the expansion of the federal child tax credit permanent; strengthening state and local policies affecting kids and families; and prioritizing racial and ethnic equity in policymaking,” it continues.

Ethen Kim Lieser is a Minneapolis-based Science and Tech Editor who has held posts at Google, The Korea Herald, Lincoln Journal Star, AsianWeek, and Arirang TV. Follow or contact him on LinkedIn.

Image: Reuters