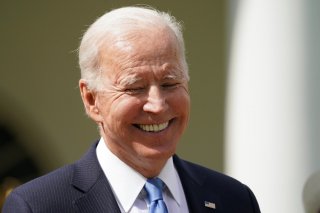

Go Joe! On July 15, Families Will Start Receiving Child Tax Credit Payments

Children between the ages of six and 17 are eligible for $3,000 each. And children under the age of six qualify for up to $3,600 each.

Here's What You Need to Remember: Parents can update information like income, marital status, and the number of dependents through an online portal that’s slated to be launched by the IRS in the upcoming weeks.

The Treasury Department and the IRS announced Monday that the advance child tax credit payments would start to arrive on July 15 for families who have eligible dependents and meet certain income level requirements.

Nearly 39 million families are expected to receive the monthly payment in July, the IRS said. The payments will arrive on the 15th of each month, and parents could get as much as $3,600 per eligible child, depending on age and their adjusted gross income.

Single parents with annual incomes up to $75,000, heads of households earning $112,500 and joint filers making up to $150,000 per year will be able to receive the full payments.

But which dependents qualify for the advance child tax credit payments?

Children up to the age of 17

Children between the ages of six and 17 are eligible for $3,000 each. And children under the age of six qualify for up to $3,600 each. That means eligible families can see monthly cash payments between $250 and $300 a month per child up until December, while the rest of the relief can be claimed on their 2021 tax returns.

Congress boosted the child tax credit in March, when President Joe Biden’s $1.9 coronavirus relief bill passed. But prior to the enhanced relief, the tax credit offered families with children 16 and younger $2,000

Dependents between the ages of 18 and 24

Biden’s rescue package expanded the eligibility pool of dependents, allowing children from 18 to 24-years-old to qualify for some tax credit.

Dependents who are 18 can qualify for up to $500 each, and children between the ages of 19 and 24 who are enrolled in college for full-time instruction can also be eligible for $500 each.

Children born before the end of 2021

Some families may be expecting a newborn before the end of this year. If that is the case, they can qualify for up to $3,600 from the child tax credit.

If families are also planning on adopting a child, parents can qualify for the enhanced credit, on the condition that the child is a U.S. citizen.

Parents can update information like income, marital status, and the number of dependents through an online portal that’s slated to be launched by the IRS in the upcoming weeks.

But before claiming any dependent for the child tax credit, it’s important that parents gather the necessary information when they file. To receive the monthly payments, the dependent must live with the parent for at least six months out of the year; the parent and the child must be U.S. citizens; at least one of the parents must have a Social Security Number or an individual taxpayer identification number if filing a joint return; the child must have a Social Security number; and parents who share custody of a child cannot both claim the credit.

Rachel Bucchino is a reporter at the National Interest. Her work has appeared in The Washington Post, U.S. News & World Report and The Hill. This article first appeared earlier this year.

Image: Reuters.