Stimulus Check Game Changer: One Thing Could Change Your Payout

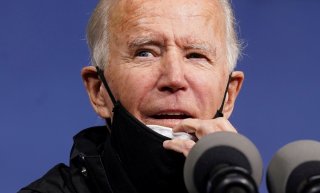

There have been reports of parents of babies born this year wondering whether their child is included in the third round of coronavirus stimulus checks under President Joe Biden’s American Rescue Plan. The good news is that parents who are eligible for the stimulus benefits do, in fact, qualify for the money.

There have been reports of parents of babies born this year wondering whether their child is included in the third round of coronavirus stimulus checks under President Joe Biden’s American Rescue Plan.

The good news is that parents who are eligible for the stimulus benefits do, in fact, qualify for the money. But the bad news is that they will have to wait until they file their income tax returns in 2022 to take advantage of the benefits.

For many financially struggling parents of youngsters amid the ongoing pandemic, the cash windfall can’t come fast enough.

Earlier this month, Internal Revenue Service Commissioner Chuck Rettig acknowledged that the agency will begin sending out monthly payments from the new $3,000 child tax credit in July.

The $1.9 trillion legislation expanded upon the child tax credit that generally allowed families to claim a credit of up to $2,000 for children under the age of seventeen.

That particular benefit now has been extended to lower-income families who otherwise wouldn’t receive such a credit. Families are now eligible to claim as much as $3,600 per year for a child under the age of six and up to $3,000 annually for children between six and seventeen.

“We will launch by July 1 with the absolute best product we are able to put together,” Rettig told the Senate Finance Committee.

He, however, admitted that launching a new program poses unique challenges, stating that “we will not risk our system.”

The IRS added that in order to ensure that eligible families receive the payment, parents must file a 2020 tax return. Without that tax return, the agency noted that it will not have the necessary information it needs to deliver the credit.

Moreover, there is no limit on the number of children in a family that can receive the credit—just as long as they meet the eligibility requirements regarding age and income.

The full credit will be given to those who have children and adjusted gross income (AGI) of less than $75,000 or $150,000 for a married couple filing jointly.

However, the benefit will phase out for individuals who make more money and cease completely for those earning $95,000 and married couples making $170,000.

This means that a family of four making less than $150,000 could potentially receive more than $14,000 in pandemic relief payments this year.

Furthermore, tax credits have been extended for another year to help cover the cost of child care. Families could get back as a tax credit as much as half of their overall spending on child care for children under the age of thirteen, up to $4,000 for a single child, and $8,000 for two or more children.

Ethen Kim Lieser is a Minneapolis-based Science and Tech Editor who has held posts at Google, The Korea Herald, Lincoln Journal Star, AsianWeek, and Arirang TV. Follow or contact him on LinkedIn.