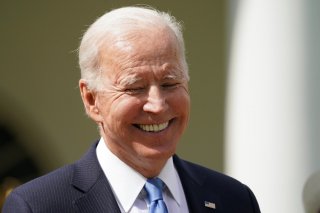

Joe Biden Is Smiling in This Photo For One Reason: Stimulus Payments Worked

The report further showed that U.S. gross domestic product rose at a 6.4 percent annualized rate during the first quarter after increasing 4.3 percent the prior quarter.

Here's What You Need to Remember: In a separate new report by LendingTree, it discovered that many Americans are tapping into the funds to settle outstanding debt. Its research showed that in March, only 19 percent of Americans admitted that they were using the latest stimulus checks for basic expenses and about half of all respondents were using the funds to pay down debt.

With tens of millions of coronavirus stimulus checks now in the hands of cash-hungry U.S. taxpayers under the American Rescue Plan, it appears that consumer spending has received a major boost, the Commerce Department reported.

The agency revealed that consumer spending in the country climbed 4.2 percent in March after sinking 1 percent in February—which was mostly in line with economists’ expectations. Consumer spending accounts for more than two-thirds of all U.S. economic activity.

The report further showed that U.S. gross domestic product rose at a 6.4 percent annualized rate during the first quarter after increasing 4.3 percent the prior quarter. Consumer spending in the first quarter surged 10.7 percent.

“While we aren’t completely out of the woods yet, today’s report shows the beginning of an economic rebound,” Brendan Coughlin, head of consumer banking at Citizens, told Reuters.

“Assuming no setback in the continued rollout of the vaccines, U.S. consumers are well-positioned in the second half of the year to stimulate strong economic growth across the country,” he added.

Some economists believe the positive numbers can be attributed to government relief programs that have already delivered three stimulus cash payments to most Americans—a $1,200 check in April 2020, $600 in December, and the current $1,400 payments under President Joe Biden’s $1.9 trillion American Rescue Plan.

And even more help could be on the way if Biden’s newest $1.8 trillion economic proposal—known as the American Families Plan—gets passed. That legislation seeks to make the child tax credit a recurring monthly payment that will last through the year 2025.

Other recently released data, however, are indicating that many Americans are tapping into the stimulus checks to meet basic everyday needs. According to a poll conducted by Bankrate, it found that a majority of the stimulus money continues to be spent on groceries, rent, mortgage, and other monthly bills. Moreover, only 13 percent of Americans anticipate using their checks for discretionary purchases, such as eating at restaurants.

“Stimulus continues to be a bit of a misnomer, with households predominantly using the money to pay monthly bills and provide day-to-day essentials. Even households with those bases covered are opting to pay down debt and boost savings—prudent decisions that lead to more sustained spending in the future,” Greg McBride, Bankrate’s chief financial analyst, said in a statement.

In a separate new report by LendingTree, it discovered that many Americans are tapping into the funds to settle outstanding debt. Its research showed that in March, only 19 percent of Americans admitted that they were using the latest stimulus checks for basic expenses and about half of all respondents were using the funds to pay down debt.

Ethen Kim Lieser is a Minneapolis-based Science and Tech Editor who has held posts at Google, The Korea Herald, Lincoln Journal Star, AsianWeek, and Arirang TV. Follow or contact him on LinkedIn. This article first appeared earlier this year.

Image: Reuters.