Zimbabwe Pushes Gold Coins as a Cure for Runaway Inflation

The government of Zimbabwe has announced its intent to lower its high inflation rate by putting up a series of gold coins for sale.

The government of Zimbabwe has announced its intent to lower its high inflation rate by putting up a series of gold coins for sale, encouraging its citizens to store value in the precious metal as the country’s inflation rate continues to grow.

The chairman of the Reserve Bank of Zimbabwe (RBZ), John Mangudya, announced on Monday that the coins would be sold in banks and could be purchased by anyone, according to Al Jazeera.

“The Reserve Bank of Zimbabwe’s Monetary Policy Committee (MPC) resolved to introduce gold coins into the market as an instrument that will enable investors to store value,” Mangudya said in a statement.

“The gold coins will be minted by Fidelity Gold Refineries (Private) Limited and will be sold to the public through normal banking channels,” he continued, referring to Zimbabwe’s state-run gold-refining corporation, which enjoys a monopoly on most gold-related transactions within the country.

The move comes after Zimbabwe’s official statistics agency announced that inflation in June 2022 had increased to 191 percent from June 2021, a roughly 30 percent increase over the previous month. The central bank noted at the time of the forecast that it viewed the recent rise in inflation with “great concern” and hoped to take steps to counteract it. Mangudya committed the central bank to drastically increasing Zimbabwe’s lending rate to 200 percent per year and raising interest rates on loans to 100 percent per year, steps that make it more difficult to borrow money, slowing circulation and preventing the dollar from appreciating.

The chairman also vowed that the RBZ would not print more money as a way to address the central government’s financial shortfalls, a move that caused inflation rates to exceed 800 percent per year in 2020.

Zimbabwe has become infamous over the past two decades for its repeated bouts of high inflation. Under the tenure of longtime dictator Robert Mugabe, the Zimbabwean government attempted to resolve economic problems in the mid-2000s by printing money, leading to a hyperinflationary spiral as the government printed successively larger sums to make up for its deteriorating value. By the time of Zimbabwe’s adoption of the U.S. dollar in mid-2009, the country’s annual inflation rate had reached ninety sextillion percent; one quadrillion Zimbabwean dollars converted to roughly $4.00.

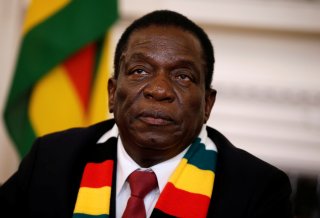

Although Mugabe was overthrown by his vice president, incumbent President Emmerson Mnangagwa, in a chaotic military coup in 2017, the new administration’s economic reform plans have stalled. Zimbabwe’s manufacturing sector remains stalled, and the country’s unemployment rate has been estimated at ninety percent. The Real Time Gross Settlement dollar, the successor currency to Zimbabwe’s ill-fated original dollar, has weakened substantially over the past year, decreasing from parity with the U.S. dollar in 2019 to roughly 350 per dollar in June 2022.

Trevor Filseth is a current and foreign affairs writer for the National Interest.

Image: Reuters.