$1,400 Stimulus Check Fiasco: Why Some Have to Return Their Payment

Some people have received the check-in error when they thought they were eligible but were not. And some have simply chosen to give the money back.

The third round of stimulus checks, brought into existence by the American Rescue Plan earlier this spring, have been rolling out to Americans for the last several weeks. Two million of the checks went out in the last round of them, which were distributed the second week of April.

Most people are thankful to receive that $1,400, and there is evidence that the distribution of the checks has been beneficial to the economy, with retail sales posting major gains in the month of March. Others are still waiting for their payments, for various reasons. But some people are faced with the need to return their stimulus checks.

Why do that? There are a few reasons.

According to Kiplinger’s, some people have received the check-in error, when they thought they were eligible but were not. And some have simply chosen to give the money back.

Among those who have received the checks, but are not eligible for them, are nonresident aliens, who are not eligible for such payments. Some, however, have received the payments in error.

However, resident aliens, who have met what’s called the green card test and substantial residence tests, are eligible for the checks.

Another reason why someone might receive a stimulus check improperly is that the intended recipient has died, and their surviving spouse receives the check. There is an exception, however, if the person who died was part of the military.

There are those who have chosen that they don’t want the money, possibly because they don’t think they need it, or they object to the notion of direct government payments. Kiplinger’s suggests that if citizens don’t want their stimulus check, that they consider donating the check to charity.

For those who have decided that they wish to return their stimulus checks, there’s a procedure for doing so, as laid out on the IRS website. Those who received paper checks are asked to write “Void” in the endorsement section, mail it to the IRS, and offer an explanation as to why they’re returning it.

Those whose checks were directly deposited are asked to write a personal check or money order to the IRS, while making it out to “U.S. Treasury,” while writing "Third EIP” on the check, also with an explanation for why they are returning the check.

The IRS site lists addresses for where to send the checks, depending on which state you live in.

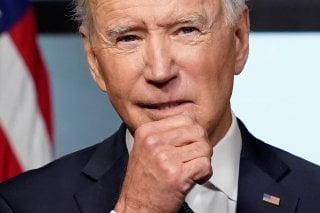

Meanwhile, there are growing calls for the Biden Administration and Congress to pursue a fourth or even a fifth stimulus with direct checks, with one nonprofit organization arguing last week that such payments are both effective and very popular.

Stephen Silver, a technology writer for The National Interest, is a journalist, essayist and film critic, who is also a contributor to The Philadelphia Inquirer, Philly Voice, Philadelphia Weekly, the Jewish Telegraphic Agency, Living Life Fearless, Backstage magazine, Broad Street Review and Splice Today. The co-founder of the Philadelphia Film Critics Circle, Stephen lives in suburban Philadelphia with his wife and two sons. Follow him on Twitter at @StephenSilver.