Eligible for Next Child Tax Credit Payment? Here’s How to Check

Just make sure to head over to the Child Tax Credit Eligibility Assistant, available exclusively on IRS.gov, which allows parents to answer a series of questions regarding themselves and their family members that will help determine whether they indeed qualify for the monthly payments.

For those hardworking parents out there still wondering whether they qualify for round two of the new and expanded Child Tax Credits, do take solace in the fact that it is quite easy to check one’s status.

Just make sure to head over to the Child Tax Credit Eligibility Assistant, available exclusively on IRS.gov, which allows parents to answer a series of questions regarding themselves and their family members that will help determine whether they indeed qualify for the monthly payments.

“This new tool provides an important first step to help people understand if they qualify for the Child Tax Credit (CTC), which is especially important for those who don't normally file a tax return,” IRS Commissioner Chuck Rettig said in a statement.

“The eligibility assistant works in concert with other features on IRS.gov to help people receive this important credit. The IRS is working hard to deliver the expanded Child Tax Credit,” he added.

Update Portal

Another noteworthy tool is the Child Tax Credit Update Portal, which should be the go-to site for parents who want to change how they would like to be paid, such as from paper checks to direct deposit. This portal offers other handy options as well, such as opting out from receiving the monthly payments so that they could potentially be eligible for a one-time lump sum during tax season next year.

“The Update Portal is a key piece among the three new tools now available on IRS.gov to help families understand, register for and monitor these payments,” Rettig noted in a statement.

“We will be working across the nation with partner groups to share information and help eligible people receive the advance payments,” he continued.

Tool for Non-Filers

The third portal—the Non-filer Sign-up Tool—is for individuals who normally don’t file a federal tax return. Using this site will give the IRS the necessary information—such as an address and routing and bank account numbers—to properly disburse the funds.

Make sure also to take note that this month’s payments will arrive on August 13, which is different from the rest of the other months that all have pay dates on the fifteenth. This is due to August 15 falling on a weekend.

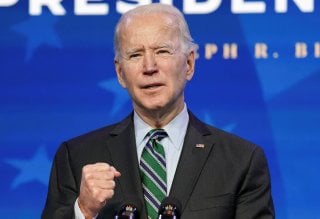

Approved under President Joe Biden’s $1.9 trillion American Rescue Plan, the expanded credits allow eligible parents to collect as much as $3,600 per year for a child under the age of six and up to $3,000 for children between ages six and seventeen—meaning that a $250 or a $300 payment for each child will be deposited into the bank accounts of parents on a monthly basis through the end of 2021.

Furthermore, eighteen-year-old dependents and full-time college students who are under the age of twenty-four will make their parents eligible for a one-time $500 payment.

Ethen Kim Lieser is a Minneapolis-based Science and Tech Editor who has held posts at Google, The Korea Herald, Lincoln Journal Star, AsianWeek, and Arirang TV. Follow or contact him on LinkedIn.

Image: Reuters