America's History of Protectionism

Protectionism has been a frequent feature of the republic since its founding.

“Please give my compliments to my friends in your state,” he told a South Carolina congressman.

And say to them, that if a single drop of blood shall be shed there in opposition to the laws of the United States, I will hang the first man I can lay my hand on engaged in such treasonable conduct, upon the first tree I can reach.

He infused the threat with credibility, and the nullification movement fizzled, though Jackson also helped craft a compromise reduction in tariff rates to somewhat mollify South Carolinians. Still, the tariff issue continued to stir political tensions throughout the country. Whereas before the Adams presidency average tariff payments generally fluctuated between 16 and 26 percent, afterward the levies typically reached 50 percent, then hovered around 35 percent following Jackson’s compromise.

That changed with the emergence of James Polk, a mild-mannered but politically obstinate Jackson protégé who became president in 1845. Polk crafted a doctrine designed to slash tariff rates while minimizing the agitations of northern industrialists. First, he insisted that tariff rates should not exceed levels needed to run the government on an economically sound basis; second, within that range he accepted targeted duties to benefit particular industries needing protection. The Polk Bill (sometimes named for his treasury secretary, Robert Walker) was generally considered a “free-trade” measure. It passed Congress in 1846 and served as the country’s fiscal foundation through the 1850s. Its tariff percentages generally ranged between 20 and 28 percent.

But the protectionist forces never accepted defeat, and in 1859 two prominent house members, Whig Justin Morrill and Republican John Sherman, crafted legislation to raise tariff rates substantially. After clearing the House, it stalled in the Senate—until Southern secession eviscerated the opposition. With the start of the Civil War, even free traders jumped aboard. The New York Evening Post, which had dismissed the Morrill-Sherman measure as “a booby of a bill,” now argued that revenue needs generated by the war demanded cooperation between free traders and protectionists. After the war, said the paper, it would go back to being a free-trade publication.

But after the war, the country was saddled with a huge war debt, and tax cutting wasn’t on the agenda. Even during the war, Congress passed, and President Lincoln signed, ten tariff bills. Lincoln, a Clay Whig from his earliest days in politics, embraced the American System with complete fealty, including the call for high protective tariffs. As early as 1832, he declared, “My politics are short and sweet, like the old woman’s dance. I am in favor of a national bank . . . and a high protective tariff.” After the war, the party of Lincoln became the party of industrial expansion, which brought an added political impetus to the protectionist commitment. Throughout these postwar decades, tariff rates often hovered over 40 percent.

When New York Democrat Grover Cleveland became president in 1885, he promptly sought to reduce tariffs, in keeping with his party’s longtime philosophy. He found an ally in House Ways and Means chairman Roger Q. Mills, a rugged Texan whose free-trade views harked back to James Polk. He thought all raw materials should be duty-free while taxes on manufactured items should be reduced substantially. Under his leadership, the House passed a bill along those lines, but in the Republican-dominated Senate it encountered the granite-like opposition of Rhode Island Sen. Nelson Aldrich, whose devotion to his wool, cotton and sugar constituents would have rendered him a protectionist even if he hadn’t been ideologically committed to that philosophy already. Aldrich and Iowa Sen. William Allison amended the Mills measure substantially, removing many items from Mills’s free list and restoring high tariff rates on numerous imports. The measure cleared the Senate and went back to the House, where it languished in Ways and Means without any prospect of reaching the floor.

Thus, as the country entered the 1888 election year, it had two different tariff bills representing two different fiscal philosophies. Republican Benjamin Harrison defeated Cleveland that November, and protectionism was immediately placed on the agenda.

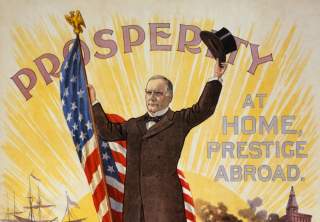

Enter William McKinley of Ohio, the new chairman of the House Ways and Means Committee. McKinley set about crafting the most comprehensive tariff bill the country had ever seen, encompassing some four thousand separate items. So earnest was McKinley in supporting protectionism that the famous progressive writer Ida Tarbell resorted to ridicule in describing him. He had an advantage, she said, “which few of his colleagues enjoyed—that of believing with childlike faith that all he claimed for protection was true.” He even sought to raise tariff rates on some items to preclude any importation of them at all, including woolens, higher-grade cottons, cotton knits, linens, stockings, earthen and china ware, and all iron, steel and metal products. McKinley placed duties for the first time on wheat and other agricultural products to address robust global increases in agricultural production, much of it with cheap labor. “This bill is an American bill,” he said. “It is made for the American people and American interests.”

The crusty Roger Mills, by contrast, rejected the idea that market constrictions could generate prosperity. What Republicans didn’t understand, he argued, was that international trade was like any other human transaction. To get something, you must give something. So it was with the foreigner who wants to sell his products. Mills declared,

Let in his cottons, woolens, wool, ores, coal, pig-iron, fruits, sugar, coffee, tea—let all these things come into the country, because when you do that something has to go out to pay for them. . . . That will create a demand for that American product.

McKinley had the votes to get his bill through the House, and Aldrich shepherded his own version through the Senate. After the “McKinley Tariff” became law in 1890, the political reaction came swiftly and severely. With Americans evenly divided between protectionists and free traders, any bill extending so far in either direction was destined to generate anxiety. Beyond that, after opponents predicted big increases in the price of household goods, clever tradesmen exploited the opportunity to raise prices even before the tariff act could have any real impact. Anxiety turned to anger. In November, Republicans took a beating in the midterm elections, and McKinley lost his congressional seat by three hundred votes. Cleveland won the White House again two years later and promptly sought to reduce tariffs once again. Although the bill that emerged from Congress at his behest did not go as far as he wanted (he let it become law without his signature), it did cut into the magnitude of the McKinley measure.

But the stubborn, plodding Ohioan refused to give up on either his political career or protectionism. He ran for Ohio governor and won, then won reelection two years later. In 1896 he ran for president successfully, largely because Cleveland’s second term was beset by one of the most crushing economic downturns in the nation’s history. Few Americans continued to press for tariff reduction like that of Cleveland’s second presidency, and McKinley found himself in a position to restore to political dominance his cherished protectionist principles. Under his stewardship, Congress passed what was called the “Dingley Tariff,” after Ways and Means chairman Nelson Dingley, which buoyed tariff rates near the levels of the McKinley bill.

But McKinley also embraced a new doctrine designed to foster international trade where, in his view, domestic manufacturers were not harmed. He dubbed this new approach reciprocity, which essentially called for negotiating reciprocal tariff-reduction deals with other countries. Their goal would be to eliminate unnecessary trade barriers on both sides of trade deals—without generating fears of resulting trade wars. Bear in mind what was happening in America at the time. Agriculture and industrial production were exploding far beyond the domestic market’s ability to absorb U.S.-made products. U.S. exports were taking off. Meanwhile, America was pushing into the world, crushing Spain in the Spanish-American War and becoming an empire along the way. It built a navy, with naval coaling stations around the globe, to protect U.S. shipping. McKinley saw that the severe protectionism he had always advocated now stood in the way of American expansionism.

He negotiated major reciprocal trade agreements with various nations, including France. But Senate Republicans, led by Senator Aldrich, balked at ratifying them. After his 1900 reelection, McKinley decided to take the issue to the American people in a series of forceful speeches touting the need for targeted tariff reductions. On September 5, 1901, at the Pan-American Exposition at Buffalo, he declared, “Isolation is no longer possible or desirable.” Powerful advances in the movement of goods, people and information across wide distances, he added, had brought the world closer together, fostering more and more international trade. America, with its vast productive capacity, stood positioned to exploit this development like no other country. “Reciprocity,” he said, “is the natural outgrowth of our wonderful industrial development.” The next day, he was assassinated.

His successor, Theodore Roosevelt, abandoned McKinley’s reciprocity initiatives and hewed closer to the Republicans’ traditional philosophy. It wasn’t until the next Democratic president, Woodrow Wilson, that tariff rates were reduced once again. Wilson also fostered ratification of the Sixteenth Amendment, allowing a federal income tax and softening the country’s dependence on tariff revenue.