A Critique of Pure Gold

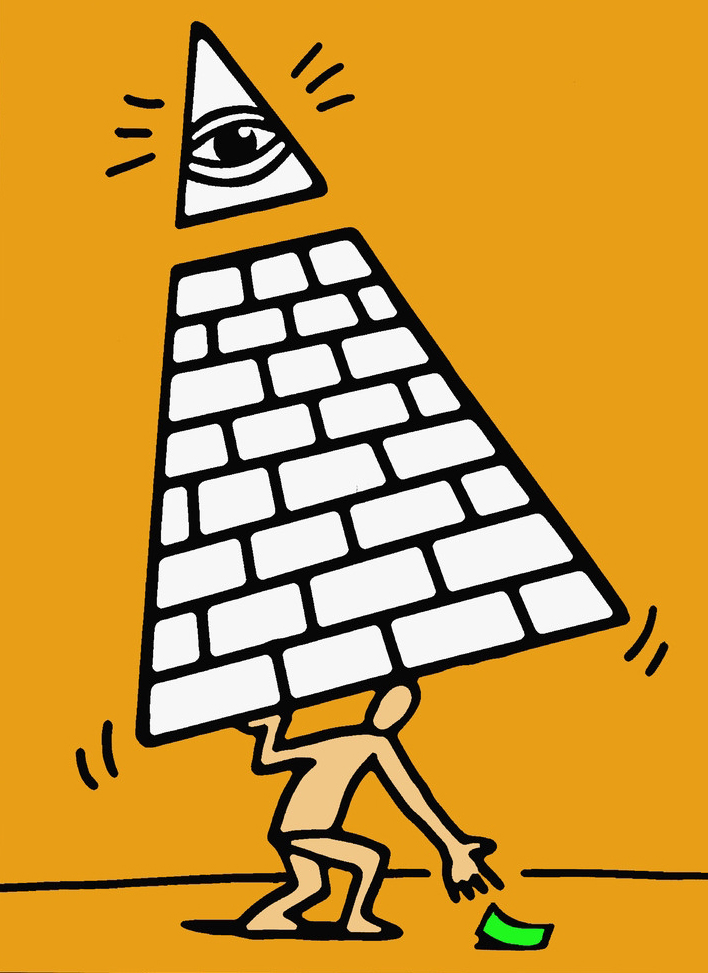

Mini Teaser: With Republicans eyeing a return to the gold standard, TNI presents a piece from its archives on tea partiers looking to push the government out of the monetary-policy-making business.

Above all they see chronic high unemployment and a sluggish recovery in the face of all this governmental intrusion into the market. They see no evidence, in other words, that the interventions undertaken in response to the crisis have achieved their goals. To someone viewing the world through Austrian-colored spectacles, the evidence would again appear to line up.

In fact, the reason that monetary and fiscal stimuli did not bring unemployment down more quickly and unleash a more robust recovery is not that they were incapable of doing so but that they were undersized. Given what we know now about the severity of the shock, by the time the Obama administration intervened with a $787 billion fiscal stimulus, that stimulus should have been at least twice as large. This is the retrospective assessment of Christina Romer, Obama’s now-former Council of Economic Advisers chair, but her conclusion is widely shared. Similarly, to prevent nominal GDP from falling, which is the litmus test of an adequate monetary stimulus, the Fed should have engaged in some $2 trillion worth of Treasury-bond purchases—not the $600 billion stipulated under QE2. This point has been made most clearly by Joseph Gagnon, a former Fed official, but he is far from alone.

In the event, the decision on the size of the fiscal stimulus was taken not on economic but on political grounds. The president’s political advisers determined, given congressional hostility to increased government spending, that getting agreement to do more was impossible or at least too costly politically. The Fed similarly concluded, given the political firestorm unleashed by its earlier interventions, that it could not make an open-ended commitment to raising nominal GDP. All that would be tolerated by Congress was a QE2 that was limited in both size and duration.

Undersized monetary and fiscal stimuli were better than no monetary and fiscal stimuli. They prevented the financial system from collapsing, the economy from falling off a cliff and the Great Recession from turning into another Great Depression. But they had longer-term costs: they failed to deliver all that was promised by their architects, whose arguments therefore came under a cloud of suspicion. Given the association of increased government spending with continued high unemployment, the former was blamed for the latter. The expansion of the Fed’s balance sheet similarly came to be seen as a cause of, not a solution to, the problem of sluggish recovery.

The only lasting answers to economic stagnation, it follows in this view, are deep spending cuts and measures to prevent the further expansion of the Fed’s holdings. And the only guaranteed way of achieving that is by putting the country back on the gold standard.

BUT TO invoke the wisdom of Herman Cain, returning to the gold standard would be more difficult than practical. Envisioning a statute requiring the Federal Reserve to redeem its notes for fixed amounts of specie is easy, but deciding what that fixed amount should be is hard. Set the price too high and there will be large amounts of gold-backed currency chasing limited supplies of goods and services. The new gold standard will then become an engine of precisely the inflation that its proponents abhor. But set the price too low, and the result will be deflation, which is not exactly a healthy state for an economy.

Given the inflation-phobic nature of gold-standard proponents, deflation would seem to be the more likely scenario. In response, we are counseled not to worry. In End the Fed Paul describes how the United States returned to the gold standard in 1879 after a two-decades-long hiatus caused by the Civil War. Resumption, as this decision was known, pegged the price of gold at levels lower than during wartime, leading to an extended period of deflation. If we could do it then, the implication follows, we can do it now.

Then again, there are some things you don’t want to try at home. The distributional effects of deflation are no happier than those of inflation. In this case it is debtors with obligations fixed in nominal terms, rather than creditors with assets fixed in nominal terms, who are unable to protect themselves. The populist revolt of the 1880s was stoked by farmers with fixed mortgages who labored under growing debt burdens and financial distress as a result of falling crop prices. Nor is deflation likely to support robust economic growth, as any close observer of the Japanese economy will tell you. Because nominal interest rates are not easily reduced below zero, the faster the price level falls, the higher will be the real interest rate (the real cost of borrowing and investing). The robust investment and job creation prized by the gold standard’s champions and the deflation they foresee are not easily reconciled, in other words.

Proponents of the gold standard thus face a Goldilocks problem: the porridge must be neither too hot nor too cold but just right. What temperature exactly, pray tell, might that be? And even if we are lucky enough to get it right at the outset, consider what happens subsequently. As the economy grows, the price level will have to fall. The same amount of gold-backed currency has to support a growing volume of transactions, something it can do only if the prices are lower, unless the supply of new gold by the mining industry magically rises at the same rate as the output of other goods and services. If not, prices go down, and real interest rates become higher. Investment becomes more expensive, rendering job creation more difficult all over again.

Under a true gold standard, moreover, the Fed would have little ability to act as a lender of last resort to the banking and financial system. The kind of liquidity injections it made to prevent the financial system from collapsing in the autumn of 2008 would become impossible because it could provide additional credit only if it somehow came into possession of additional gold. Given the fragility of banks and financial markets, this would seem a recipe for disaster. Its proponents paint the gold standard as a guarantee of financial stability; in practice, it would be precisely the opposite.

The Austrian response is: eliminate the lender of last resort and crises won’t happen in the first place. The kind of reckless risk taking that led to the recent financial crisis won’t take place if there is no longer an expectation of bailouts. The strongly procyclical behavior of money and credit that has underwritten destructive boom-and-bust cycles in the past will be no more. As Paul has put it:

Rampant monetary growth has led to historic high asset inflation, massive speculation, over-capacity, malinvestment, excessive debt, negative savings rate, and a current account deficit of huge proportions. These conditions dictate a painful adjustment, something that would have never occurred under a gold standard.

About this last assertion, history suggests otherwise. Bank lending was strongly procyclical in the late nineteenth and early twentieth centuries, gold convertibility or not. There were repeated booms and busts, not infrequently culminating in financial crises. Indeed, such crises were especially prevalent in the United States, which was not only on the gold standard but didn’t yet have a central bank to organize bailouts.

The problem, then as now, was the intrinsic instability of fractional-reserve banking. Banks are financial intermediaries. They are in the business of lending out the money they borrow from their depositors. This means that they keep on hand as reserves only a fraction of their deposits. But this exposes them, by their very nature, to a problem of confidence. As in the famous scene in It’s a Wonderful Life, if depositors lose confidence in the security of their funds, for any reason, they will demand them back, but the bank will not have them in liquid form. Moreover, because banks operate in the information-impacted part of the economy—they are in the business of acquiring information about specialized borrowers whose prospects are difficult for arms-length capital markets to assess—information about their own financial condition is necessarily imperfect. This is why confidence problems are intrinsic to fractional-reserve banking and why an economy with a modern banking system needs a lender of last resort.

Credit Paul, once more, for anticipating the objection. The problem with the U.S. financial system, he argues, is not simply fiat money but fractional-reserve banking itself. And the solution, which should go hand in hand with restoring gold convertibility, is eliminating the latter. Banks should be required to limit their investments to liquid assets that can be sold off immediately in response to depositor demands. Banks would be forced to behave, in effect, like high-quality money-market mutual funds.

Not surprisingly, there were proposals along these lines, labeled “narrow banking,” in the wake of the recent financial crisis. But it is not hard to see why they failed to take off. Where, under such a system, would firms go for working capital? One answer is nowhere: they would be starved of funding. Another answer is that they could turn to a separate set of nonbank financial firms authorized to lend longer term than they borrow and otherwise permitted to take on risk. But this second solution, such as it is, would simply shift the locus of risk rather than eliminate it. It would not remove the need for a lender of last resort but only change the name of the financial institutions that needed to be bailed out.

Image: Pullquote: Bizarre is the belief that putting the United States on a gold standard will somehow guarantee balanced budgets, low taxes, small government and a healthy economy.Essay Types: Essay

Pullquote: Bizarre is the belief that putting the United States on a gold standard will somehow guarantee balanced budgets, low taxes, small government and a healthy economy.Essay Types: Essay