Biden Claims Republican Midterm Victory Will Make Inflation Worse

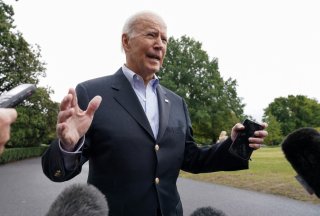

“If Republicans win, inflation’s going to get worse. It’s that simple,” the president said during his visit to Los Angeles on Thursday.

President Joe Biden contended this week that inflationary pressures, which are currently sitting at roughly forty-year highs, will only get worse if Republicans win control of Congress in November’s midterm elections, The Hill reported.

“If Republicans win, inflation’s going to get worse. It’s that simple,” the president said during his visit to Los Angeles on Thursday.

“We’ve got an election in the month. Voters have to decide. Democrats are working to bring down the cost of things they talk about around the kitchen table, from prescription drugs, to health insurance, to energy bills, and so much more,” he continued, adding that he “just couldn’t disagree more with my Republican friends who say the biggest problem in our economy right now is that working folks are making too much money.”

Biden’s remarks come as the Labor Department announced on Thursday that the consumer price index (CPI) was found to have risen 0.4 percent for September and 8.2 percent on an annual basis, as climbing food and rent costs again offset moderating gas prices. The cost of groceries rose 0.7 percent, placing the twelve-month increase at 13 percent, while rent costs jumped 0.8 percent and 6.7 percent on an annual basis. Core inflation, which excludes volatile food and energy items, was up 6.6 percent compared to a year ago, the largest annual gain since August 1982.

The new CPI numbers are indicating that more aggressive interest rate hikes are likely going forward from the Federal Reserve. Last month, the Fed signed off on a third straight seventy-five-basis-point interest rate hike and suggested that it will keep raising rates well above the current level. With the move, the central bank took its federal funds rate up to a range of 3 percent to 3.25 percent, the highest level since the global financial crisis in 2008. The Fed’s median estimate shows that rates are projected to reach 4.6 percent next year.

Despite the ongoing headwinds seen in the economy and markets, Moody’s Analytics chief economist Mark Zandi said that he believes that inflation will be cut in half within six months.

“The consumer price inflation will go from something that’s now about a low of over 8 percent year-over-year to something close to half that of 4 percent,” he said on CNBC on Wednesday.

“The real hard part is going to go from 4 percent back to down to the Fed’s target. And on CPI, the high end of that target is probably 2.5 percent,” he continued. “So, that last 150 basis points—1.5 percentage points—that’s going to take a while because that goes to the inflation for services which goes back to wages and the labor market. That has to cool off, and that’s going to take some time.”

Overall, Zandi said that the Fed’s hawkish stance is putting the economy on the right track.

“Job growth is starting to throttle back. And then, the next step is to get wage growth moving south, and I think that’s likely by early next year,” he said. “That’s critical to getting broader service price inflation moderating and getting inflation back to target.”

Ethen Kim Lieser is a Washington state-based Finance and Tech Editor who has held posts at Google, The Korea Herald, Lincoln Journal Star, AsianWeek, and Arirang TV. Follow or contact him on LinkedIn.

Image: Reuters.