Study Counters Claims That the Child Tax Credit Increased Unemployment

New research may undermine arguments that the child tax credit encouraged unemployment.

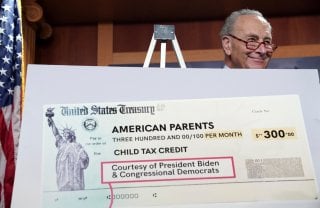

During the second half of 2021, when the expanded child tax credit provided most American families with payments from the federal government each month, a debate was had over whether such payments discouraged people from entering the workforce.

In late 2021, as an extension of the credit was being debated, Congressional Republicans on the Joint Economic Committee argued that continuing the credit would “discourage a return to work for many of America’s most needy families.” A University of Chicago study led by economist Bruce Meyer projected that as many as 1.5 million parents could leave the workforce as a result of the credits.

"The proposed expansion would get rid of the strong work incentives under the prior CTC; it would essentially eliminate a tax credit that encouraged work and replace it with something that discourages work," Meyer told CBS.

The expanded child tax credit expired at the end of 2021, causing the credit to revert to its pre-American Rescue Plan levels. But now, a new study says that the expanded credit did not, in fact, reduce employment in 2021.

The study, which draws on census data, is titled “Expanded Child Tax Credit Payments Did Not Reduce Employment.” Stephen Roll and Yung Chun of Washington University in St. Louis authored the report with Leah Hamilton, a professor at Appalachian State University.

“CTC recipients tended to be employed at higher rates than nonrecipients, and that employment was stable for both groups,” the study said. “In the new year, employment declined amidst a rising COVID Omicron variant, but the decline was sharpest for CTC recipients once the expanded CTC was terminated” at the end of the year.

The report also concluded that there was no evidence that employed parents “switched the type of job they held” as a result of the credit.

“There is no evidence within the Census Household Pulse data—a large, high-quality, nationally-representative data source—that CTC payments led parents to leave the workforce,” the study concluded.

“Our analyses also found no significant differences in employment rates for low-income, middle-income, or high-income families receiving the CTC. We also see no evidence that the CTC is increasing the proportion of parents who are staying home with their children rather than working.”

The results, the authors said, are consistent with previous studies from the likes of the Center on Poverty and Social Policy.

“Taken together, the research indicates that providing parents with financial support for their children is not leading them to forgo employment income altogether. We intend to update this report periodically with new waves of the Census Pulse survey.”

Stephen Silver, a technology writer for The National Interest, is a journalist, essayist and film critic, who is also a contributor to The Philadelphia Inquirer, Philly Voice, Philadelphia Weekly, the Jewish Telegraphic Agency, Living Life Fearless, Backstage magazine, Broad Street Review and Splice Today. The co-founder of the Philadelphia Film Critics Circle, Stephen lives in suburban Philadelphia with his wife and two sons. Follow him on Twitter at @StephenSilver.

Image: Reuters.